CPhI Pharma Insights - China 2016 Market Report

China 2016 Market Report

CPhI Pharma Insights reports: CPhI, the world’s leading pharmaceutical networking event, with over 100,000 attendees globally–is now using its collective resources to create Pharma Insight reports, analysing individual parts of the pharma industry as well creating the well respected and eagerly anticipated Annual Report featuring a global panel of experts (now in its second year).

The vision is to harness the power of CPhI’s independent position within the industry so that it can produce unbiased analysis of the global pharmaceutical industry and help to see emerging trends and bring different perspectives together. The Annual Report utilises expert in-depth essays, looking at future contingencies, whilst the Pharma Insights series takes perspectives from CPhI exhibitors and the wider industry.

To get more information on how CPhI events can drive forward growth and new business opportunities for the pharma community, please visit www.cphi.com

Introduction

As the second largest healthcare market in the world,China has established itself as a significant player in the manufacturing of pharmaceutical products, with the majority of its manufacturing growth largely focused on APIs and generics thus far (in the lower cost per kilogram category). However, an expanding middle class population and increased gentrification within the world’s most populous country, has underlined an overall increase in healthcare standards and spending. This has provided an impetus and incentive for Chinese manufacturers to now start investing into higher margin products and biologics,consequently attracting both domestic and foreign investment into the Chinese pharma industry.

This report builds upon research collected from 223 international and 71 domestic companies of the pharmaceutical industry, and aims to present a holistic overview of the Chinese pharma market. It discusses the potential for investment and exports, highlighting the excitement surrounding the emerging R&D (research and development) in the sector and the impending expansion within the overall Chinese pharma industry.

Growth Drivers

China’s economic growth and surge in its middle class is ushering in a new and more expansive pharma market as the incidence of urbanisation-related diseases increases. The fundamental elements significant in sustaining the growth of this market are:

1) More affluent lifestyles increasing life expectancies and the risk of age-related diseases; and allowing high-fat diets that increase the risk of obesity-related diseases.

2) Industrialisation-correlated increases in the incidences of respiratory diseases and cancers.

3) Shifts in general healthcare culture: increased awareness and more regular medical screenings, allowing for higher rates of disease detection.

4) Increasing demand for higher-quality drugs and medical technology over what is cheaply available domestically

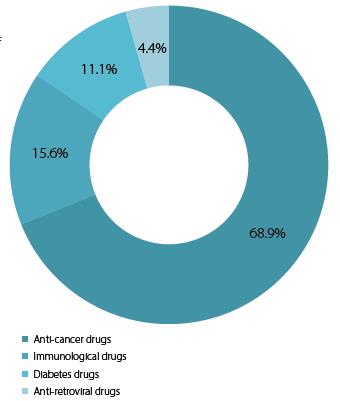

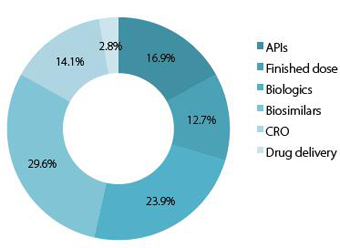

In accordance with the demand for foreign, higherquality brands, chemotherapeutic agents are the most popular class of biopharmaceutical products in domestic development, making up almost 70% of the industry.This could include cytotoxics but with the growth of the biologics market, this is perhaps more likely to be antibody drug conjugates (ADCs), monoclonal antibodies (mAbs),and protein- and cell-based therapies.Immunological and diabetic agents are also commonly priducted(though to a far lesser extent),reflecting the rise in societal diseases seen in many other developed countries

Chart 1: Domestic respondents: Main types of biopharmaceutical product classes that are being

worked on in China

Domestic Manufacturing

Since 2011, new regulations of good manufacturing practices(GMP) have narrowed the gap in the quality of products manufactured by local companies and foreign multinational companies (MNCs), with local manufacturers also supported by the Chinese government through various measures such as the accelerated approval of products involving local intellectual property (IP) and the provision of extra resources for further innovation. Chinese companies continue to dominate the generic-drug market as they occupy a lowercost position and are prepared to face lower returns.

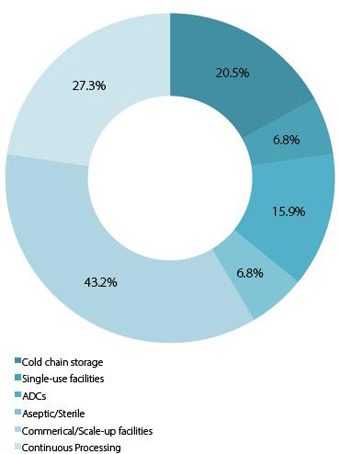

Chart 1a: Domestic respondents: Types of technologies investing in

Not only have local GMP regulations developed following the American and European GMP models, but also has administrative supervision significantly tightened,reducing the corruption in the regulation, implementation,enforcement and inspection of practices. This is of considerable significance as it increases the attraction for international companies looking to enter the Chinese market as 77% of them already implement the GMP standards that Chinese firms are now adopting.

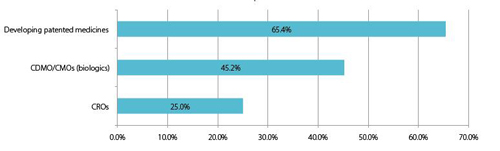

Chinese companies are increasingly investing for the future,with 21% investing in cold chain storage technology,16% in ADC development, 43% commercial and scale-up facilities and perhaps most interestingly, 27% in continuou sprocessing. Continuous processing remains at the cutting edge of the industry and is predicted to revolutionise pharma manufacturing over the next decade. However, its initial set-up costs and new learning’s are high, implying a significant change in approach from Chinese companies. Moreover, as the government promotes the consolidationof local entities into larger, more powerful companies,1several Chinese MNCs may begin to appear in the next 5 years. Interestingly, 65% of international respondents believe these emerging MNCs will be developing their own drug and technological patents. Another factor driving this development up the pharmaceutical value chain has been the recent emergence of CROs, CMOs and CDMOs. These organisations are developing their own manufacturing facilities locally and bringing in expertise from companies overseas; in the longer term, it is likely we will increasingly see drugs designed for the Chinese market that are patented,developed, researched and manufactured within China. Clearly, the ultimate goal for the Chinese government is to develop its pharma industry into the beginnings of a Big Pharma rival to the established powers in the US and Europe. What is also significant is that Big Pharma and foreign MNCs have clearly recognised the potential within this market and are seeking to gain access as quickly as possible over the next few years (if they have not already done so).

Clearly, entry into the Chinese market is a high priority for foreign firms in order to participate in this major growth period. One approach the majority of Big Pharma and generic companies are investing in is the building of local manufacturing facilities within China over the next 5 years. These provide the advantage for a lower–cost production base, with the ability to build bespoke state-of-the-art facilities that meet with their international quality standards. This approach also comes with the advantages of government support, enabling stronger reimbursement positions,and more rapid launches of new products as Chinese sites must be included in clinical trials for the local release of novel drugs.1

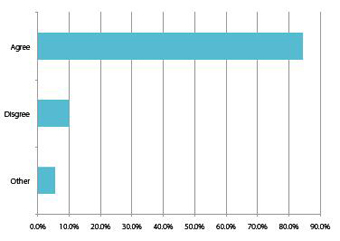

Big Pharma in China are now working on developing new strategies to harness the potential within this market and are no longer relying on solid dose and generic product portfolios. One segment of the pharma industry that appears to have great potential within China is the biologics and biosimilars sector, due to the global pharmaceutical pipeline, but it is also a clear reflection of the number of biopharmaceutical facilities within the country. In fact, over 80% of foreign respondents predict that China will have the fastest evolving biologics sector over the next decade and rapidly rising sales. Similarly, despite its huge existing API and generics industry, over 50% of Chinese companies believe growth will be fastest in biologics and biosimilars, amongst all of its pharma supply segments.

Chart 2: International respondents: China will be the country with the fastest growing biologics sector over the next decade.

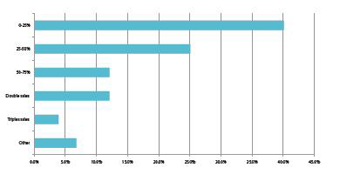

The majority of foreign companies are forecasting explosive growth in China as the country’s healthcare system evolves over the next 5-years. Not only do 60% of foreign organisations, who are already present in the market,project their sales will grow by more than 25%, 15% are even predicting a staggering growth of 200% or greater over the next 5-years. Similarly, over 70% of Chinese firms are either ‘confident’ or ‘extremely confident’ in the sustained buoyancy of the Chinese market and 65% of Chinese firms expect a growth of around 20% in the next year alone. A further 26% anticipate growth at 20-40%, with 8% expecting to double in size. This suggests that despite a recent, relative slow-downin the overall Chinese economy, the pharma sector remains extremely buoyant.

Chart 3: International respondents: Predicted sales growth in China for the next 5 years

Chart 3a:Domestic respondents:Segment of the pharma industry that will evolve the fastest?

Challenges

In the midst of the country’s indisputable financial growth,there are a number of challenges that, if left unchecked, will put a break on the country’s speed of growth. For example,the Chinese government is reported to tightly control the pharma market and 76% of international respondents have stated that their investments or progress in China have been hindered by regional regulatory delays. The majority of respondents feel that the ‘CFDA approval process is getting slower as manufacturers do not yet know how to implement the changes’ and 72% go further and believe that ‘a US-style GDUFA fee system’ is much needed. The prerequisite of paying to register drugs it is hoped will deter companies from registering drugs they have no intention of making, thus clearing existing backlogs, and speeding future approvals. To further emphasise this concern and the apparent insufficient resources of within the CFDA, an overwhelming 94% of Chinese companies believe the ‘CFDA must quickly grow to a more comparable size with its US counterpart if it is to properly regulate its industry’.

In 2015, rule changes abolished the drug mark-up policy in hospitals and reduced the incentives to over-prescribe more-expensive drugs. Thus, Big Pharma is no longer able to enjoy the higher confidence in foreign brands or the premiums generated by the use of high-priced originator or innovative drugs when alternative cost-effective, local generic products were available.2 Moreover, in 2016,demands were made for drugs of major disease classes tobe cut in price. Through the cap in hospital reimbursements of state-run insurance funds, prescriptions of more expensive drugs have understandingly fallen. Moreover, due to the lack of national pricing standards, both domestic andforeign companies are required to negotiate individually with local authorities to sell their products within provinces,cities and hospitals.In the short term, these healthcare cost-controls, increased competition from domestic manufacturers, and China’s (relatively) slowing economy, have threatened Big Pharma’s profit margins and slowed their recent sales. For example,GSK experienced a 25% decline in pharma sales and Merck’s revenue growth in the fourth quarter fell from 13% to 2%,while AstraZeneca’s revenue growth fell from 18% to 6%.3

In terms of local manufacturing, whilst the fundamentals of economic growth and local production bases remain true, there are still a number of challenges that the industry needs to address. For instance, the experience and knowledge base of the Chinese pharmaceutical industry is still understandably behind those of the US and of Western Europe. In fact, some 75% of surveyed Chinese executives believe China’s own universities are holding back the full potential of the Chinese industry – as they are not yet producing suitably qualified graduates that can easily translate their knowledge into research and pharmaceutical manufacturing environments.

Returning with New Knowledge

As a potential solution to this on-going problem,remarkably 40% of senior management and scientific personnel within Chinese companies have spent time abroad in Western markets to further their experience and technical knowledge. Another response to this has been the increased graduate migration of university students to foreign, high-ranking, Western universities. Increasingly, we have seen large and growing numbers of Western-educated graduates returning with life-sciences qualifications and it is estimated over 100,000 foreign-educated PhDs have returned to work in China.4

Foreign Investment

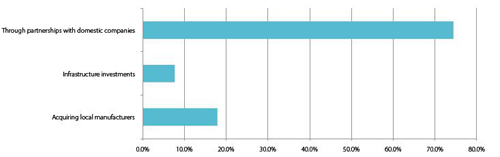

Despite some concerns, there is an overwhelming interest and confidence in investing in China’s thriving pharma market. Partnerships with domestic firms are the prevailing method of entry, as they allow foreign companies to circumvent the regulatory and cultural obstacles that oppose them, whilst also limiting initial investment levels. For example, the ‘complex registration process and vague requirements’ of the Chinese regulatory body has introduced various uncertainties and difficulties in the development, manufacturing and importation of pharma products, particularly of advanced biologics. Partnerships with local companies that already possess established distribution networks and advanced knowledge of the laws, regulations and different tiers of the Chinese market are common, with almost all (74%) correspondents planning to either initiate or increase these arrangements.

Chart 4:International respondents: How have you entered or planed to grow in the Chinese market?

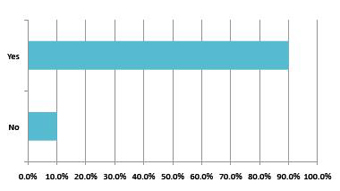

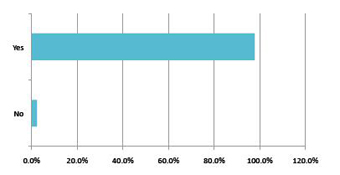

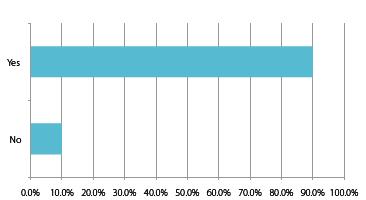

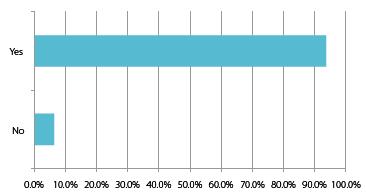

Looking at this from the domestic manufacturers’ points of view, there is a clear desire to bring in international partners to help them adopt more advanced manufacturing techniques and products. The belief here is that to sustain the next level of growth, domestic manufacturers need to advance their knowledge and manufacturing technologies to adequately respond to the growing healthcare demand within the country. As a result of this, more than 90% of domestic firms are looking to grow their foreign partnerships over the next year alone.In particular, domestic manufacturers are seeking new packaging and drug distribution technologies so that they can meet and further develop biological products.It is clear that domestic partnerships will be mutually beneficial and will grow extremely quickly over the coming years.

Chart 5: Domestic respondents: Looking to work with foreign partners in the next years

Chart 6: Domestic respondents: If yes, is this to increase the company’s knowledge/development base?

A second market entry strategy adopted by larger MNCs is the acquisition of local manufacturing sites, with 1 in 5 looking at targets over the next year. However, for even the largest of pharmaceutical companies, there is a clear reticence of investing in and building their own facilities and distribution networks for direct market access – with less than 10% considering this a viable option.

There is clearly a large amount of ambivalence in the market as there is a tremendous desire and enthusiasm to enter the Chinese market quickly, yet on the other hand,the West is still very distrustful of Chinese IP protection, knowledge and quality standards – with over 60% of respondents stating that they ‘would invest more in China if IP protection was more stringent’.

The increased confidence in IP protection is also expected to secure more R&D activities and investment domestically.Local R&D centres enjoy access to a low-cost base,increasing scientific capabilities, large patient pools,greater insights into the China’s pharma market and of course, the regulatory authorisation to sell drugs that have gone through domestic clinical trials. Furthermore, 77% of international correspondents believe drug makers will begin to conduct R&D and focus development on specialist drugs that offer personalised care for China’s unique healthcare needs, such as the more common liver diseases and certain cancers, to better reach the Chinese market.

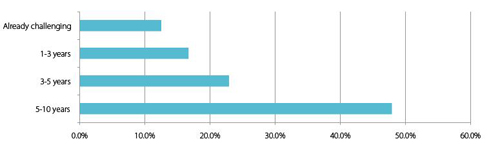

To contrast the Chinese pharma market with the other major pharmerging economy, India, it is clear that India’s pharma industry is led primarily by its export potential, not by the domestic healthcare economy. As a result, it has acquired higher standards in finished dose production and is exporting to even tightly regulated markets. However, its R&D industry and biologics sector clearly lags behind the developmental potential within China. As China attempts to cultivate a favourably regulated, high-quality market and assumes its position as the world’s second largest investor in biopharma R&D, almost 50% of Chinese respondents believe China will have the capability to challenge Western biopharmaceutical companies in complex formulations,bio-innovation and advanced manufacturing techniques within the next 10 years. The clear implication here is that India will remain the preferential low-cost market for finished formulations of solid-dose drugs and generics but China may soon emerge as a low-cost market for biological products. Our Chinese respondents predict a period of 6-7 years to be the tipping point for the realisation of this potential. However, emphasising the duplicitous nature of Chinese responses, the majority of respondents believe Chinese biopharma R&D still lags behind that of the US, Europe and even India. There is a clear desire from government and industry to improve quickly, the real question is how realistic it is to achieve such ambitions so quickly. The US and Europe have been developing its pharma industry for more 50 years.

Chart 7: Domestic respondents:How long until China has capability to challenge Western biopharmaceutical companies in complex formulations, bio-innovation and advanced manufacturing techniques?

Export Potential

In the longer term, thanks to a rapidly improving domestic regulatory environment, there is a very bright future ahead for Chinese exports. Up until now, and as previously contrasted with the Indian pharma market,‘the domestic pharma economy has driven the country’s growth potential with international regulatory standards largely an afterthought’. Simply, Chinese companies could achieve enormous growth without the need to achieve international standards. This position would probably have continued had the domestic market not changed its viewpoint with a clear desire for higherquality drugs from a growing and influential middle class.

However, this is not the say Chinese exports are in any way trivial. There is already an existing vast export of API and generic exports into emerging and lower-cost markets. Thousands of small-to-medium sized firms are already supplying markets in Africa, Central and these have been for drug products below the $100 per kilogram category, where economies of scale and costadvantages define manufacturers.

One other factor contributing to increased confidence in exports has been the adoption of supply-chain controls,with 34% of Chinese respondents commenting that serialisation has improved their capacity to export to emerging and regional markets in Southeast Asia.

The domestic pharma market drives China’s growth and export potential. A wave of R&D and biotech innovation will lead to a large biologics economy with a massive export market predicted in just five years

Domestic Market Driving Change

As Chinese consumers become increasingly aware of healthcare standards, they are beginning to realise the difference in quality between domestic and foreign brands, and preferring the latter. Many Chinese companies are aiming to expand overseas and meet international product standards and regulations, particularly those of the American or European markets. Acceptance into such markets would strengthen brand credibility and build trust both domestically and overseas – essentially, domestic gentrification is driving the country’s export potential.

Furthermore, higher margin, lower volume, finished formulations may begin to be produced domestically as demand from Chinese consumers reaches a critical level. With the government’s dedication in improving R&D capabilities; partnerships between Chinese and foreign pharma allowing insight into international regulations, demand, technology and resources; and the sufficient money and scale of domestic firms in becoming potential national leaders; it is now realistic to speculate that Chinese MNCs will emerge and develop their own patents and finished formulations. In fact, 65% of international respondents believe this will occur in the next 5-10 years.

Chart 8: International respondents: China will have multinational companies in the next 5 years that are:

However, this perspective comes with the caveat that there is still a long way to go. Last year’s CPhI China report noted that China’s rising dominance in APIs and generics could be hindering its advances overseas, and perhaps now, changes in infrastructure may be required. For example, the vast majority of product recalls are for secondary packaging, and clearly, this is an area for major improvement.

Despite these obvious challenges to overcome, Chinese companies still remain extremely confident with 45% believing China will be a ‘major exporter of finished forms to Europe and US in the next 5 years.’

The general consensus is that Chinese manufacturers will first expand into the biologics sector and new emerging highgrowth markets like South America, before steps are made towards complex finished formulations.5 Interestingly, near term growth in biologics is predicted by 40% of Chinese companies to predominantly come from domestic sales with support from international sales, while 30% predict international sales to dominate with support from domestic sales.

Traditional Chinese Medicines

Besides biologics or finished formulations, TraditionalChinese Medicines (TCMs) have also been prioritised as a strategic domestic opportunity for both international and domestic companies, with some growth in exports surprisingly predicted. The consensus (79%) amongst the international pharma and generics community is that these products are highly desired by the Chinese market, and they should therefore also be looking at growth opportunities here as well as in the traditional product classes.6 Financial support from the government has also allowed the construction of key TCM research labs and greatly advanced the technology, management and quality of the TCM R&D sector. Remarkably, a growing intersection between the TCM and biotech sectors is appearing as biological assays screen TCM products to isolate their natural and therapeutically active compounds.4

Outsourcing

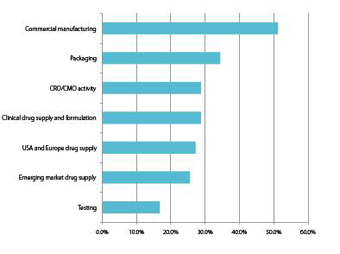

The improvement in manufacturing quality to international standards has led to an increased outsourcing activity from Big Pharma to Chinese CMOs and other local manufacturing providers. For example, AstraZeneca has constructed a dedicated sourcing centre in Shanghai,which has reportedly saved 10% on purchasing orders so far. Furthermore, of the international respondents that were looking to outsource, 51% now believe that commercial manufacturing could be competently undertaken within China – which reflects well on the country’s efforts to improve regulations, manufacturing standards and IP protection. Additionally, 35% of the international companies surveyed stated they would also outsource packaging within China and even use a Chinese CRO/CMO (29%). However, there is slightly less confidence for supplying drug products into the US and European markets(27%), and emerging markets (25%). Most notably of all,confidence was lowest in the outsourcing of analytical testing to China with just over 15% of respondents stating it could be competently outsourced.

Chart 9: International respondents: If you are planning to expand your manufacturing base in China, which services do you feel can be competently outsourced?

65% of international companies forecast that China will be developing and marketing patented medicines (probably biologics) within five years

Conclusion

Despite the obstacles of China’s pharma market and the country’s relative economic slowdown, the overall market is expected to rise to approximately $315 billion by 2020.7 Such trajectories of future growth remain too compelling for foreign pharma to retreat from the market, who are instead opting to adapt their strategies in line with local conditions.

Chart 10: Domestic respondents: New packaging and drug delivery technologies are urgently needed in China to meet biologics under development

To ensure China’s overall pharma economy expands as expected, it will however have to overcome its challenges in packaging and drug delivery technologies, but more crucially, CFDA needs to grow at the same pace as the industry, and it would not be surprising if a US-style GDUFA system was implemented in a few years’ time.

Chart 11: Domestic respondents: Think CFDA needs to grow quickly to a more comparable sie with the US FDA to properly regulate the industry?

What is clear from both a domestic and international perspective is that local partnerships and knowledge are going to be integral to those achieving the most impressive growth rates. International companies are predicting huge returns and percentage sales increases within China over the next five years, unilaterally this is through partnering,acquiring or working alongside Chinese companies (to gain the required local expertise).

However, it is interesting that this desire for increased domestic-international trade is also shared by Chinese companies who are actively seeking the input of international providers to help them modernise their operations more quickly. But clearly, foreign pharma must act quickly to lay its foundation in the region, before the next phase of expansion occurs.

In the last 10 years, the Chinese pharma economy has been incredibly successful in rapidly growing its generics and API industries, and this growth, particularly for lower margin APIs is continuing apace. We should also see some of the larger Chinese companies also developing more advanced APIs and high-potent products, within the near future –predictions suggest the value of the API market will rise to $180 billion by 2020.8 But, what is surprising, is that both international and domestic companies do not foresee the Chinese economy as a whole becoming a major player within finished dose supply and exports – clearly too much ground has been ceded to Western and Indian manufacturers. However, with several factors now coming together, we will see China move up the pharmaceutical value chain. Notably, it is forecasted that the biologics and biotechnology industry should see the most rapid expansion and China is predicted to begin to rival industries in the US and Europe in as little as 5 years’ time.This new biotech-focused growth proposition has been encouraged by the Chinese state, which has prioritised the longer term growth opportunity from biologics and biosimilars, concentrating investments here – almost to the neglect of establishing an export market for finished dose formulations.

On-the-ground biologics research is encouraging a new breed of more advanced CROs and CMOs. This, coupled with the need for local knowledge within the market and increased trust from international companies, alongside a tighter regulatory environment, is encouraging a new powerful sector to form with MNCs predicted to emerge over the next couple of years. Already, we have seen trust increase with nearly 50% of international companies feeling confident to outsource at least part of thempharmaceutical value chain. This trend is set to accelerate as the majority of Chinese companies are investing in at least one of GMP, QbD, OPEX, six-sigma or continuous improvement. The catalyst for this change has been the rising awareness within the Chinese middle classes who are seeking more tightly regulated and higher-quality drugs – as a result, both in the short and medium term,there is a huge opportunity for companies that can move onto higher standards of regulation and quality control.But what is most remarkable of all of these changes is that they appear to have occurred in the last couple of years and are now predicted to accelerate and proliferate rapidly. In 5 years’ time, we could be looking at a very different Chinese market with generics and APIs still being exported in huge volumes, but alongside this, we will also see a well-established biologics and research industry,and multinational CMOs exporting to emerging markets and, perhaps even into the West. The most startling finding however, is the prospect of Chinese biotech research producing drug targets that were discovered in China for Chinese populations (predicted to occur in 5-10 years’ time). Moreover, it is likely that these targets can be clinical-trial-manufactured by Chinese CDMOs, researched by Chinese CMOs, and distributed by Chinese partners. Essentially, this will be the American Big Pharma model established in the emerging power of China – a bold prediction indeed, made not by Chinese companies but by the international community looking to enter the market.

Methodology

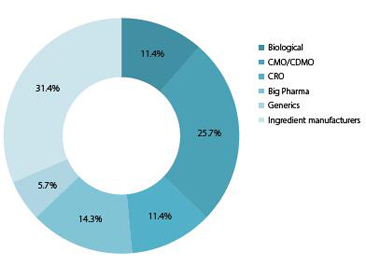

This report was written and produced by De Facto Communications for UBM EMEA by analysing the interview transcripts and predictions of 223 international and 71 domestic companies, associations,experts and executives of the pharma industry – from Big Pharma, generics companies, CDMOs to distributors, biologic/biotech providers, ingredient manufacturers and CROs.

Chart 12: Domestic respondents: Which description best fits your business activity?

1. Wong J, Wu C & Xia M (2014) New Rules for Winning in China’s Pharmaceutical Market. The Boston Consulting Group.

2. Leung P, Shieh G & Xu E (2014) Embracing China’s brave new pharmaceutical world. Bain & Company.

3. China’s Drug-Price Cuts Are Hitting Big Pharma Where It Hurts. Bloomberg (2016).

Link: http://www.bloomberg.com/news/articles/2016-03-08/big-pharma-s-china-dreammeets-reality-of-price-cutting-campaign .

4. L Giniat E, Fung P, Weir A & Meyring N (2011) China’s pharmaceutical industry – Poised for the giant leap. KPMG.

5. China: domestic growth to outpace exports, forecasts CPhI China 2015 report. Manufacturing Chemist Pharma (2015). Link: http://www.manufacturingchemist.com/news/article_page/China_domestic_growth_to_ outpace_exports_forecasts_CPhI_China_2015_report/111112 .

6. van Liedekerke B & Wang X (2009) Investing in China’s Pharmaceutical Industry. PricewaterhouseCoopers.

7. China’s Upcoming Pharma Market Boom: Over 650% Revenue Growth by 2020, Forecasts GlobalData. GlobalData (2013). Like:

https://healthcare.globaldata.com/media-center/press-releases/pharmaceuticals/chinas-upcoming-pharma-market-boom-over-650-revenue-growth-by-2020-forecasts-globaldata .

8. China Pharma Industry. CPhI China (2016).

Link: http://www.cphi.com/china/visit/why-visit/china-pharma-industry

About CPhI

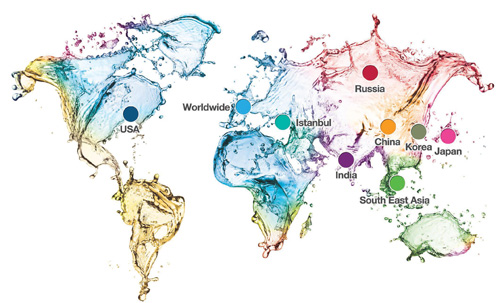

CPhI drives growth and innovation at every step of the global pharmaceutical supply chain from drug discovery to finished dosage. Through exhibitions, conferences and online communities, CPhI brings together more than 100,000 pharmaceutical professionals each year to network, identify business opportunities and expand the global market. CPhI hosts events in Europe,China, India, Japan, Southeast Asia, Russia, Istanbul, Korea and South America co-located with ICSE for contract services, P-MEC for machinery, equipment & technology, InnoPack for pharmaceutical packaging and BioPh for biopharma. CPhI provides an online buyer & supplier directory at CPhI-Online.com.

For more information visit: www.cphi.com

CPhI Global Events

CPhI and P-MEC China 21–23 June 2016

CPhI Korea 23–25 August 2016

CPhI Worldwide 4–6 October 2016

CPhI India 21–23 November 2016

Pharmapack Europe 01-02 February 2017

CPhI Istanbul 8-10 March 2017

CPhI Southeast Asia 22-24 March 2017

CPhI Russia 28-30 March 2017

CPhI Japan 19-21 April 2017

CPhI North America 16-18 May 2017

CPhI Conferences year round

- Laboratory Corporation of America® Holdings Successfully Completes Acquisiti 9/8/2016

- CPhI Pharma Insights - China 2016 Market Report 7/1/2016

- IDT Acquires SURVEYOR® Nuclease Business from Transgenomic 7/2/2014

- SP Industries Acquires Bel-Art Products 7/2/2014

- Roche Invests in Stratos Genomics for Further Development of the “Sequencing By 6/27/2014

- OGT to sell Cytocell products direct in North America 6/3/2014

- AZBIL TELSTAR OPENS ITS NEW SUBSIDIARY IN BANGLADESH 4/21/2014

- ProBioGen and Merus Sign Deal on GlymaxX® ADCC Enhancement Technology 3/5/2014

- Agilent Technologies Reports First-Quarter 2014 Results 2/17/2014

- Fluidigm Completes Acquisition of DVS Sciences 2/14/2014